interest tax shield formula

Calculating the tax shield can be simplified by using this formula. Thus a tax shield is an amount by which the depreciation and amortization or any non-cash charge lower your income subject to taxation creating cash savings.

Tax Shield Meaning Importance Calculation And More

Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million.

. This is usually the deduction multiplied by the tax rate. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you 3500. The Interest Tax Shield is similar to the Depreciation.

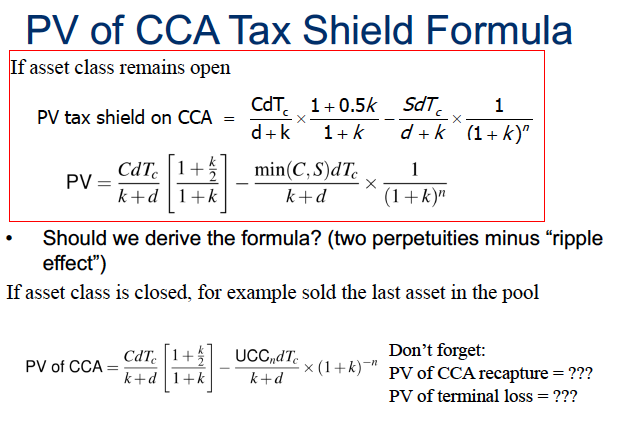

In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the following example. The Depreciation Tax Shield reflects the Tax Savings from the Depreciation Expense deduction. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

Tax Shield 45. A companys interest payments are tax deductible. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a tax rate of 15.

Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900 So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. Interest Tax Shield NPV P NPV A An alternative approach called adjusted present value APV discounts interest tax shield separately.

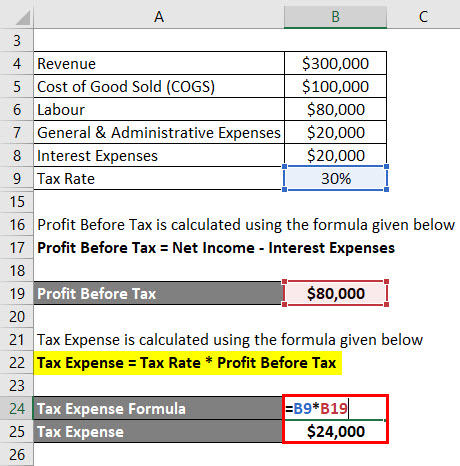

Any expense that lowers ie. Shields taxes paid is a Tax Shield. Interest Expense 20000.

Present value PV is the current value of a future sum of money or stream of cash flows given a specified rate of return. If you wish to calculate tax shield value manually you should use the formula below. Interest Tax Shield Formula Average debt Cost of debt Tax rate.

Without the tax shield Company Bs interest payment is just an expense that decreases a firms profitability and hits its cash flow. Else this figure would be less by 2400 800030 tax rate as only depreciation would remain the deductible expenses. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

Cash Flow and thus directly impacts Valuation. That is the interest expense paid by a company can be subject to tax deductions. Depreciation Tax Shield Formula Depreciation expense Tax rate.

Interest Tax Shield Interest Expense x Tax Rate Thereby the APV approach allows us to see whether adding more debt results in a tangible increase or decrease in value as well as enables us to quantify the effects of debt. Tax Rate Tax Deductible Expenses1 Add Expenses Remove Expenses Results. In such a case the tax shield is computed as follows.

The tax shield arises from the deductibility of interest paid and increases the value for shareholders. And an interest expense of 10 million. Sum of Tax Deductible Expenses 10000 Tax Rate 40 Tax Shield Sum of Tax Deductible Expenses Tax rate Tax Shield 10000 40 100.

Thus Taxable Income declined from 1000 to 955. The interest tax shield formula. How does interest tax shield affect the value of a company.

Tax Shield 30015. Tax Shield Deduction x Tax Rate. Tax_shield Interest Tax_rate.

Tax rate 35. For example there are some cases where mortgages have an interest tax shield for the buyers as the mortgage interest is deductible on the income. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula.

The Depreciation Tax shield directly affects Income Taxes paid ie. The effect of a tax shield can be determined using a formula. To learn more launch our free accounting and finance courses.

Interest Tax Shield Formula The interest tax shield can be calculated by multiplying the interest amount by the tax rate. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax. Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375 Interest Tax Shield Formula The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below Interest Tax Shield Average debt Cost of debt Tax rate Recommended Pages Depreciation Tax Shield Calculator.

This small business tool is used to find the tax rate by using interest expenses and depreciation expenses. Interest Tax Shield Example. Tax Shield Deduction x Tax Rate To learn more launch our free accounting and finance courses.

Interest Tax Shield Interest Expense Tax Rate. What does PV mean in accounting. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

Even though the APV method is a bit complex it is more flexible because it allows us to factor-in the risk inherent in admissibility of interest tax shield. Interest Tax Shield Formula Average debt Cost of debt Tax rate. Such a deductibility in tax is known as interest tax shield.

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Interest Tax Shield Formula And Excel Calculator

Chapter Ten Making Capital Investment Decisions 2003 The

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula Step By Step Calculation With Examples

Adjusted Present Value Apv Formula And Excel Calculator

Edit This Is All The Information Provided It Is Chegg Com

Tax Shields Financial Expenses And Losses Carried Forward

Earnings Before Interest After Taxes Ebiat Formula And Calculation

Berk Chapter 15 Debt And Taxes

Depreciation Tax Shield Formula And Excel Calculator

Nopat Formula How To Calculate Nopat Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)